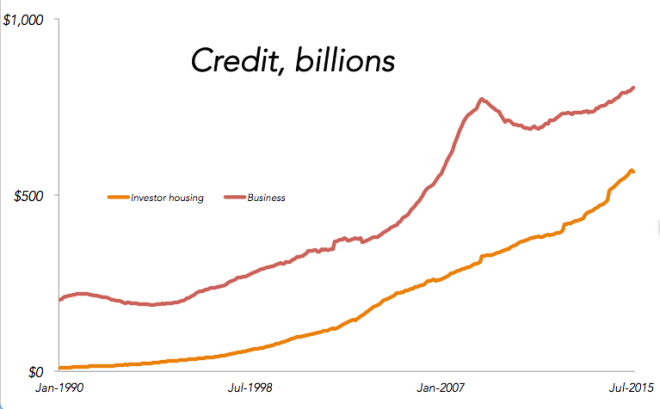

Is the housing sector so pumped full of credit it is about to explode? Or is the business sector so credit starved it is about to die?

- Comment

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.

Was 1990 a low point for investors in housing or is this trend really coming from near zero before 1990?

LikeLike

Good question that I can’t answer. The series starts in 1990, at $10.5bn.

LikeLike

Of course it’s a combination of both, but if I had to pick a score I’d say, 60:40 businesses are starved more than the housing sector is inflated. Housing in mining regions seems to be immune to all of the help builders are getting. It’s not a good time to sell in Central and North Queensland. I imagine a market correction showing the bubble bursting in urban metropolitan cities, but this being somewhat smoothed out by gains in regional housing as service sectors increase.

Meanwhile, as the dollar continues to drop coupled with declines in commodity prices and the like, businesses will continue to tightrope walk over leveraged lines to compete.

LikeLiked by 1 person