This story originally appeared over at The New Daily (a news site you ought to check out). They’ve agreed for me to host it here too.

–

CostCo has been running in Australia for six years now, but the big American retailer just opened its first stores in Brisbane and Adelaide in the last 12 months.

Shopping at Costco is a rollercoaster ride. Here, for the uninitiated, are the Six Stages of Costco.

1. Fearing

In this stage, the shopper is bewildered by the membership-based discount warehouse concept.

Those in the fearing stage can be identified by the following class of statements:

Costco sounds weird. Is it just a supermarket? I can’t find a catalogue online.

It’s not near my house. How do I get there?

I hear it costs $60 to even be able to shop there! Who do they think they are?

Many will never leave this stage. Those that do will likely make the leap because of word-of-mouth. (Costco doesn’t advertise).

2. Learning

In the learning stage, the shopper’s fear and confusion is rapidly replaced with a sense of wonder.

The shopper begins to form an elementary map of their Costco store and assumes they will one day be able to navigate it confidently. (This assumption is false.)

The learner can be identified by the following kind of statements.

Look at the size of this place! Wow!

Things are so cheap here! I can get Veuve Clicquot around $50 a bottle!!

It’s mostly real brand name stuff – Nutella, Sony, Levis. It’s not like Aldi.

There’s even jewellery for sale … and you can buy holidays!

You can get a hot dog at the end for just $1.99. Delicious.

Coming to Costco is fun. It’s more like a theme park than a supermarket!

3. Loving

In the loving stage, the shopper’s very identity seems to merge with their membership of the discount warehouse.

You don’t need to ask to identify them as a Costco lover: they’ll tell you. You will be subjected to non-stop statements like these:

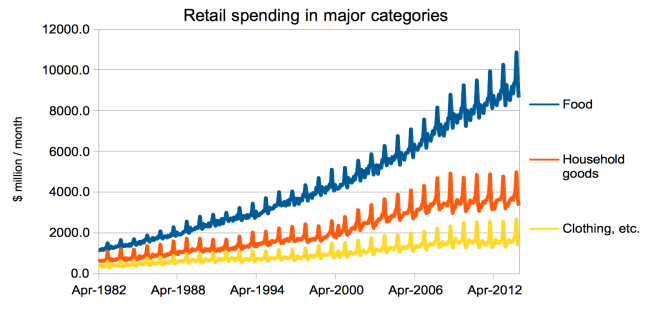

Did you know Costco works out 15-25 per cent cheaper than Coles or Woolworths on a per kilo basis?

Have you tried their beef? OMG. The quality is to die for.

Did you know the CEO of Costco pays himself just a third of what the Walmart CEO gets, while they treat their staff better than most other retailers?

You must come to Costco as my guest! I’d be delighted to take you!

The typical Costco lover is happily middle class. (Costco sells a lot of smoked salmon.) The Costco experience actually takes money to enjoy, given the fees, the need to go by car, and the need to spend hundreds per visit to harness the discounts.

Some people never leave this stage. They’re in retail nirvana. (Some of these people live near a Costco that does discount petrol and make their savings on fuel alone.) But there’s plenty of shopper with three more stages to go.

4. Realising.

In the realising stage, the Costco shopper learns thousand-dollar shopping trips can have a nasty hangover. You can spot the realiser by these mutterings:

Did I need to buy 1000 zip ties? And a kilogram of Hersheys kisses?

Why is there never any ******** space in my ******* fridge?!

Shame I couldn’t get through all those avocados before they went brown.

Yes, I can take you to Costco (again) to stock up on things for your party. Yes, taking a guest is one of the good things about the membership. No, I don’t mind.

Those cheap hotdogs are revolting.

The realiser has a few more unhappy moments coming.

If they darken the doors of the local Coles or especially Aldi, they may make the following realisation – not everything is cheaper at Costco. There are some non-perishable things Costco may be unbeatable for – pet food, or toiletries – but not everything.

5. Calculating

In the calculating stage, the shopper looks at some very long receipts with some big numbers on them. They try to quantify the opportunity costs that come with bargain hunting.

Here are some notes they may make on their spreadsheet.

If I save 20 per cent per $200 shop, but succumb to two $20 impulse buys I shouldn’t have, my savings are gone.

If I get a second freezer to freeze bulk meat, its going to cost me about $400 and then at least $100 a year in electricity. Hmm.

If I drive an extra 30 minutes to the Costco and back, and spend an extra 30 minutes shopping and waiting in line, I need to make sure the savings are worth 90 minutes of my time. So if I get paid $30 an hour, I need to save $45 per shop to break even. Plus petrol.

6. Quitting

The quitting stage is not spectacular. There’s no more excited chatter. The quitter quietly lets their membership slide.

Costco is growing and its stock price is double what it was five years ago, so the quitting stage doesn’t happen to everybody. But it happens to some.

For this group Costco is like an old friend you don’t see any more, and you wonder what you ever had in common. Maybe you are missing a screaming deal on a TV or some new tyres, but you know what, being a bargain hunter doesn’t seem like the most important thing in your life any more.

Maybe this is you, maybe it isn’t. But no matter what, before you quit, stock up on that cheap champagne!