Was the problem a shortage of cool plans? I didn’t realise the problem was a shortage of cool plans.

Yesterday, Tesla announced two new vehicles – a semi trailer, and a roadster. The launch was awesome.

Musk does theatre like a natural. Adding to the happy vibe was that he spent no time covering Tesla’s big problem, which is delivering on existing plans. Instead, he added more plans.

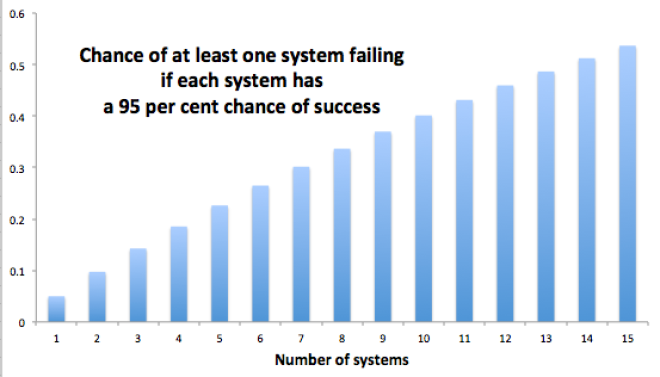

Here’s the problem with plans. Not everything works out. The more plans you have the more chances for something to go wrong.

When you have many independent systems, adding an additional system adds to your chance of one working.

However when each system is interlinked (by, say being in the same corporate structure, or worse, by being an input to another system) the rising chance of one failure increases the chance of mutliple failures.

For example, the gigafactory battery plant is an input to the Model 3 production line. Failures at the gigafactory are holding up production, imperilling the Model 3 and the whole company’s cashflow, and therefore its survival.

When you have interlinked systems, risk management is, in the long run, almost everything.

If you google “Elon Musk” and Risk, you find a lot about him worrying about the risk from artificial intelligence to human survival. And I could see nothing about him discussing his approach to risk management in business.

SELF CONFIDENCE

Elon Musk has a longstanding pattern of managing risk by insourcing. When something’s not going right he tries to solve it by doing it in house, or even personally.

Most recent example is the purchase of the tooling company Perbix. … Prior to that they sacked their self driving supplier MobilEye and rebuilt the systems from scratch. Before that they bought Solar City.

Is it clever to insource everything?

Nobody wants their supplier to go broke because they forced the supplier to take on too much risk. If it happens you’re short on inputs. But if you bring the problem under your own roof and find it can’t be solved then you’re short on inputs and in a financial hole.

A list of things Tesla is doing in house that a regular carmaker doesn’t is… eye-opening.

- Fuelling stations

- Dealers

- Repair shops

- Energy generation and storage systems. (solar panels and batteries)

- Developing autonomous driving systems

All of these are tricky. They may cost more to do than expected.

Just because this looks like a car company doesn’t mean it has the risk profile of a car company. Building cars is not the only prerequisite for success.

And of course Tesla is having all sort of trouble building cars. It has had big hiccups making the batteries and doing the welding. It also likely can’t fit all the planned production inside its current factory, meaning it will need a new factory to hit 500,000 cars a year. Tesla is being broadly upfront about this, with Musk referring regularly and breezily to “production hell” – although without giving much detail.

Solving production hell will take management effort and money. But the two new vehicles will divert effort and money. A juggling analogy may be apt. When you add extra balls, the juggler trying to control them drops the lot, not just the new ones.

The recent release of negative stories about the culture inside Tesla may be an indicator a breaking point is near.

OPTIMIST PRIME

The Roadster has some serious technical questions to answer, but – if it can be built – of course they can sell a lot of copies. It’s the world’s fastest car from the world’s coolest brand.

The truck, however, is not certain to sell. While consumers buy on brand and image, the logistics industry is relentlessly optimised around cost. The range Tesla’s truck offers (500 miles) demands an enormous battery, which will make the truck expensive to buy and increase its weight by an estimated 12 tons. That weight matters for at least three reasons

1. The total weight to payload ratio changes, offsetting some fuel advantages.

2. Road damage increases exponentially on a weight per axle basis and governments are increasingly keen to get the logistics industry to pay road user charges based on weight.

3. Trucks are sometimes empty and carrying a battery at those times raises the cost.

The truck also means Tesla had to invent a whole new charger to make sure their trucks could be charged in a reasonable time (30 minutes for 400 miles). It is unclear to what extent this new Megacharger has been invented as opposed to just envisioned. It is further unclear how much they might cost to install, or if they are compatible with existing electricity distribution infrastructure.

Incidentally, the time it takes to charge a vehicle means Tesla may need to install a high ratio of chargers to vehicles on the highways. We’ve all pulled into a petrol station to find all the pumps are in use. You wait three or four minutes and they become free. If the person in front of you is going to take 30 minutes to charge, and then you’re going to take another 30 minutes, you’ve got an enforced one hour stop. God forbid it’s busy and there’s more than one person in line in front of you.

The way for Tesla to combat this inconvenience is by installing *a lot* of chargers at places where people are taking long trips. (This problem should not apply at home, where people can charge their vehicle overnight, but it would apply if you’re doing distance travel, and especially to semi trailer trucks.)

CAPITAL IDEA

The Tesla semi trailer and the roadster are, however, not just extra risk. They can help Tesla raise capital it sorely needs. Pre-orders of the first 1000 roadsters are available by putting down $250,000. If they can find 1000 people willing to put 250k on ice for a few years, that will put $250,000,000 into Tesla’s pockets. Its most recent cash burn was $1.4 billon in a quarter, so $250 million would buy them an extra three weeks.

Every little bit helps!

Think I’m being excessively mean? Read why here: Why does Elon Musk make me so Cross?

Thank you for this observation from a business/economics perspective, I can’t disagree.

From what I can observe Tesla has just above 2 quarters left before using up their cash and cash equivalents, and one of the major challenges is that they are still struggling to ramp up Tesla 3 production, the sales of which is needed to keep their business viable.

I work in the automotive supplier industry and have involvement myself on production planning and delivery schedules before, and can attest to the fact that a smooth production ramp-up is crucial for business. Have a fully staffed factory, supplier base, SG&A and other overheads and not being able to delivery products to cover such costs, no doubt the Tesla people are under enormous and sustained stress.

From a marketing perspective it is cool to get the sample shop to put together a truck and a roadster, but automotive manufacturer’s bread and butter is volume production of cars (that’s true even for exclusive cars). Horse and wagon are both needed, but the horse has to come before the wagon.

LikeLiked by 1 person

This.

The cost of having a big factory and workforce not producing enough is hard for some lay people to grasp. They instinctively get the advantage of making a really lean, efficient robotised factory. They get the economies of scale. But they don’t intuit the cost of waiting. Every moment of downtime is costs going out without revenue coming in. It’s accrued losses which are a weight the company must carry into the future in the form of debt.

The longer insufficient production goes on the higher future margins have to be to pay back this period of loss making. It goes on long enough the advantages of a ‘better’ production process are gone.

LikeLike

“The longer insufficient production goes on the higher future margins have to be to pay back this period of loss making.”

It looks like they are starting to lose their credibility on their ability to pay back accumulated losses: https://www.cnbc.com/2018/03/28/teslas-junk-bond-tanks-to-87-cents-on-the-dollar-after-downgrade.html

Tesla is highly priced, generating only net cash outflow after paying expense and debts, and is sustained up to now by continuous capital appreciation and faith – a lot like what Australians call negative gearing.

LikeLiked by 1 person

One theoretical possibility for electric vehicles is to have removable batteries. That way you could optimise the weight of the vehicle to the distance traveled. During week days our car does a lot of short distance trips with the average being less than 10kms. Occasional longer trips of 50-100kms might happen once a month or less and longer trips of 300kms only happen a couple of times a year. It’s great having the convenience, but loading extra batteries for a long trip wouldn’t be that difficult. After all you still need to fill up more often on longer trips in conventional cars.

LikeLike

That is not a bad idea. Not necessarily just to manage weight but to manage the time it take to refuel.

I went to the service station last night to swap over our bbq gas bottle. Nobody expects me to refill the bottle. Would it work for car batteries? Or, because batteries degrade over time, would it be too annoying for people?

LikeLike

You could just rent the batteries I guess. Pay a deposit and just swap them over. I guess the business models will sprout up to find the most efficient method :D

I suppose the holy grail is the driverless car that you just pay for when you need it, and it takes care of the charging. You could even imagine a smart system where you changed vehicles to make use of sharing sections of the commute.

LikeLiked by 1 person

Very good title ‘Optimist Prime’.

To further fund Tesla car factory, Elon should do the same as roadster pre-sales with Outerspace ticket pre-sales.

LikeLiked by 1 person