Things look bad.

Today, economic growth figures are coming out (at 11.30am) and for the first time in ages, people are predicting negatives.

Recession talk is in the air. I have my doubts about that. But the talk alone is very suggestive, and there are lots of reasons for it.

Chinese markets are falling, our own stock-market is in a sustained slide, and with all that bubble talk our housing construction sector looks weaker.

Is Australia about to get a surge of growth, or a slump?

Is Australia about to get a surge of growth, or a slump?

One way to answer that is to look at what business is up to. In May, we checked in with business spending plans and they gave me intestinal cramps. Things have changed, sort of…

Capital expenditure is what makes your business bigger, lets you employ more people, etc. It’s one of the big signals of future economic growth. And it’s going backwards.

The mining sector is in such a funk that it won’t bring us any growth. This next graph shows the plans the mining industry has for capital expenditure.

The grey bars show actual expenditure. The last one for 2014-15 is the lowest in four years. The white ones are plans for next year. The latest white bar (3rd estimate for 2015-16) is the lowest 3rd estimate in five years. That is having a seriously negative effect on Australia’s total capital expenditure. Check out the increasing steepness of that slope at the end.

That is having a seriously negative effect on Australia’s total capital expenditure. Check out the increasing steepness of that slope at the end. Manufacturing won’t save us.

Manufacturing won’t save us. But there’s other parts to the economy. Other selected industries are investing more than ever.

But there’s other parts to the economy. Other selected industries are investing more than ever.

Other selected industries sounds like a miscellaneous grab-bag. But check out the labels on the vertical axes. This is a massive part of our economy. Not only that, it just invested more than it expected, which is more than ever. Plans for 2105-16 are more modest, but increasing fast. Other selected industries* includes:

Other selected industries* includes:

Electricity, Gas, Water and Waste Services

Construction

Wholesale Trade

Retail Trade

Transport, Postal and Warehousing

Information Media and Telecommunications

Finance and Insurance

Rental, Hiring and Real Estate Services

Professional, Scientific and Technical Services

Accommodation and Food Services

Administrative and Support Services

Arts and Recreation Services

In other words, a whole lot of important parts of our economy that we can actually believe in.

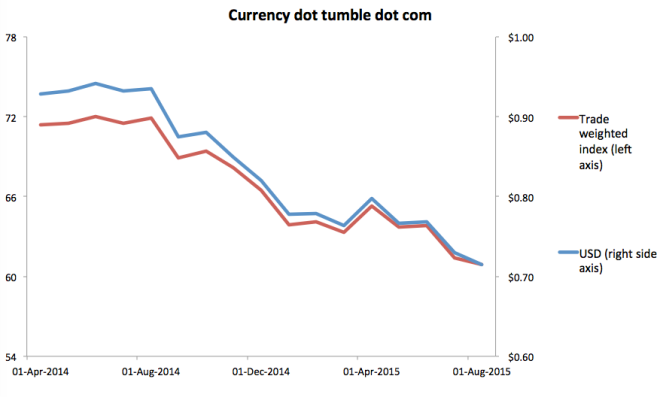

And there’s one simple reason why they might grow. Our falling dollar.

The fall in our currency is a bit like being a lobster in a boiling pot of water. Unlike stock market fluctuations it happens slowly and we don’t pay it so much mind. But it matters a lot.

The fall in our currency is a bit like being a lobster in a boiling pot of water. Unlike stock market fluctuations it happens slowly and we don’t pay it so much mind. But it matters a lot.

The slow growth of non-mining industries in the last few years can be attributed to our high dollar. America’s incredible recovery from its recession in the same time period can be explained by its low currency.

A falling dollar could flip slow growth on its head. And we’d be too busy worrying about mining to notice.

The current mood of widespread gloom may prove to have been peak fear.

*This whole private capital expenditure data-set excludes healthcare and social assistance, which as we know, is one of the fastest growing sectors of the economy. In Melbourne, a billion dollar new cancer hospital is being built, for example. That’s not in the stats. Further reason to hope.

Is the investment bump directly attributable to the government’s small business write off policy?

LikeLike

That’s a good question. It could be!

LikeLike