I haven’t posted for a while, because I was overseas. A good holiday should refill the tanks of any economics blogger with ideas and stories, and this trip – to the USA – was no exception.

The story I will tell today was about an economic concept I never expected to think about. Timeshare.

We were in Utah about three weeks ago, walking up Main Street in Park City, after a delicious dinner of ribs. The Main Street there is the beneficiary of generous heritage laws that preserve the low-rise, weatherboard feel of the mining town Park City once was.

These days, the town mines wealthy visitors for their gold, a vein that has proved far deeper and richer than those geological deposits long since exhausted.

Past the galleries and fine dining establishments we sauntered until we came across a storefront featuring an ugly yeti sitting in a busted-up old armchair. The yeti was so out of place among the aura of refinement that I stopped and looked at it. It plays no further role in this story, but it serves as a sort of turning point, because the yeti explains why I was stationary long enough for a salesman with a lazy eye and a flat cap to entice me inside his storefront.

“Want some free ski passes?” he yelled out. In this environment awash with expensiveness (we had just split a $29 plate of ribs between two at the restaurant, braving the wrath of the service staff) the prospect of saving a few dollars seemed wise. We stepped inside to learn more.

The salesman, named Gino, managed quite easily to convince us to attend a timeshare presentation two days later, with only a modest amount of stretching the truth. In return for an hour of our time listening to the amazing deal offered by the Hilton Grand Vacations Club (he eventually conceded it would be 90-120 minutes), we would be given two free tickets to the ski resort of our choice.

We had planned to ski at the swank resort of Deer Valley, and the tickets there cost $114 each. The payoff looked good. Gino promised a car would collect us from our accommodation to take us to the timeshare presentation. That was attractive because the presentation was at a resort we wanted to go to, which was a bus-ride away. Right at the end of his sales pitch, he revealed that there was a forfeitable $20 deposit that we would pay in cash now and receive back at the end of the timeshare presentation.

By this stage the decision had been made and we handed over a greenback. The whole deal was formalised on a contract on Hilton letterhead, with the time our driver would arrive, promises that we met a certain minimum income level, and our reward of free ski passes.

As we left Gino and his yeti to lure further punters, we seemed to have executed quite a coup! We were obviously never going to buy the thing. And Gino said the timeshare presentation would be replete with refreshments.

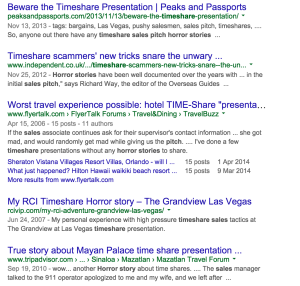

But later that night, back at our accommodation, Google put the frighteners on us.

We read of timeshare presentations that would last for four hours. Of intimidation, bullying and lies. Of being bounced from salesman to salesman each time they said no. Of people buying a timeshare just to bring the experience of the presentation to an end. Horror stories filled the Google results.

I lay awake thinking of strategies that might convince the salesman we truly didn’t want or couldn’t afford the thing. The irony of missing a day’s skiing stuck in some ridiculous presentation in order to gain a free day of skiing was abundantly clear.

When the day dawned and our big white GMC SUV came to collect us at 8:30am, as promised, I had a strategy prepared.

The driver delivered us to the Hilton property at the Canyons ski resort exactly as promised. The vibe in the foyer was weird. The sales staff were loitering around and they looked professional. These were not young people moon-lighting in the game. They were old white men who gave the impression of having sold thousands of timeshares each. As we helped ourselves to the promised refreshments (juice, coffee, pre-packaged danishes – all a bit disappointing) we overheard the oldest salesman, aged perhaps 65, lecturing a man of about 55 on the appropriate length for his hair (shorter.)

Our salesman was named Sy. He was perhaps 45, and his name-tag said he was from Las Vegas, Nevada. We went from the plush foyer to a much more mundane office area, with many small cubicles purpose-built for selling timeshare. Other couples wandered round after their salespeople, as if in a daze.

Sy seemed open and honest. Early in the piece I rolled out my managment strategy – one of total honesty. I told Sy about the yeti, about Gino the salesman and his promises of free ski passes, about our excitment and then our nervousness when we read the horror stories on the internet.

Sy took this in his stride, promising to have us out of there within two hours. He wanted to know our professions, he wanted to know how much annual leave we got and he wanted to know how much we were paying for our accommodation in Park City. Our answer on this latter point visibly shocked him, because I had spent a lot of time shopping around for a good deal, and booked a place that seemed like it had been unrenovated since 1965.

Sy very much enjoyed multiplying things together on his calculator, and he showed us that if we spent that much on accommodation for two to three weeks every year for 40 years, we’d have spent tens of thousands of dollars. Lucky for him we did not mention the trip we took to China 18 months ago where we got double rooms in youth hostels at about $50 a night, because that would have ruined his sums.

The way the timeshare works is – of course – complicated. You can enjoy it in the classic sense, by simply showing up to the same location at the same time every year, but the sales pitch steers you away from that idea with the promise of points.

These points are granted every year, and appear to offer greater value when deployed staying in other properties globally (there seemed to be about 50) as detailed in a very glossy brochure.

Instead of one week in Utah, we could get three weeks in Italy, or about 20 weeks in Las Vegas in the off-season. Points could be shifted forward or back one year, but would, after two years, expire if unused. Except they wouldn’t actually expire! They’d turn into Hilton Honours points and be spendable at an even greater range of properties, as detailed in another very glossy brochure.

The right to the timeshare would exist in perpetuity, and never expire. Our grandchildren’s grandchildren could still be enjoying a week in Utah every year, Sy insisted.

I wanted to know more about the money side of things, and hear less about the points, but those figures would not be revealed until after the property tour. We set off.

It was opulent beyond belief. These were not standard hotel rooms. Sy said the development had been built as condos and then the whole thing was sold off in the GFC when the developer went under. Hilton snapped them up. He claimed they were being rented for $2000 a night in the high season, and I believed it. They were giant.

Finally, 100 minutes after our arrival, we started talking money. I’d been wondering at the buy-in cost and had no sense of whether it would be $10,000 or $200,000. It came in at the lower end of my guesses, at $43,000 for a two bedroom property (with two kitchens, so it could be split into two normal size hotel suites).

There was, of course, an annual maintenance fee of $1200, to keep the property looking Hilton quality. The maintenance fee actually seemed pretty good to me, given the places were fully furnished, stocked with cutlery and crockery, etc. There were also booking fees of $60 or so if you wanted to use the property. And if you didn’t have $43,000 now, you could pay it off with finance at a rate of 5%, plus a closeout fee of around $1000 when the mortgage was done.

But where Sy’s calculator heroics really turned me away was when he tried to account for inflation.

He asked me what I thought was a fair rate of annual inflation and applied that to the expected accommodation expenditure stream over 40 years that we had estimated before.

But did he use it as a discount rate? No. He actually tried to inflate my expenditure stream over 40 years to make it look even bigger than the present day expense of $43,000.

At that point, I understood. Timeshare is for people who don’t understand the time value of money. Future expenditure is worth less, not more, than current expenditure.

Also, paying upfront for holidays depends on bad reasoning about the stability of your demand for holidays over time – and also your ability to pay for them. Lives can change in a way that make regular holidays a distant memory.

Timeshare also depends on misunderstanding the stability of the hotel business. If Hilton goes bust, or decides to close its timeshare operations, the value of the property will sink.

Furthermore, nowhere in the entire presentation was there anything about the rate of return you could expect if you never used the property and simply rented it out. That’s a flashing red warning that the rate of return starts with a minus sign.

Sy also mentioned that if you wanted to sell the property, Hilton had first right at buying it back. This made sense given what I’d read online, which was that second-hand timeshares sold at significant discounts to the sticker price.

After this sales pitch – which felt like an endurance race – finally got to the end, I rolled out part two of my salesman management strategy.

I repeated the key parts of his presentation back to Sy so he couldn’t get the impression I didn’t understand. Then I clearly and politely made an unambiguous statement: “There is absolutely no way we want to buy this.”

Right then, Sy handed over an envelope with two free ski passes and our $20 in cash, and let us go! It had been, in the end, far easier and less stressful than I expected. I attribute that in part to clever management by us, and in part to the selection bias for horror stories on the internet that had shaped my expectations.

Two hours work, for $114 value. Plus free coffee and juices and a free ride in a car. So, is sitting through a timeshare presentation worth doing in the middle of your holiday?

That depends on how you value your time on that particular day. But one thing is clear – agreeing to endure the sales pitch is much better value than agreeing to buy the actual timeshare.

Yeah do it. As long as you have there personality and confidence to deal with salespeople.

I had two nights for the whole family (of 4) at a Sunshine Coast resort for $50, including breakfasts and access to all resort facilities for sitting through a similar timeshare sales pitch. Totally worth it for a cheap holiday. The timeshare? Total ripoff.

LikeLike

One thing I read online said it was a battle of two sales pitches. The salesman selling the deal vs you selling the idea that you don’t want the deal

I imagine that you could become quite confident in your ability to win that battle, and come out ahead every time. But the first time through was actually a bit stressful!

LikeLike

Great article Jase! Great because I got to relive my experience of timeshare sales in Vegas. They had a full busload of people they shipped out to a resort in Vegas. Similar experience but they did pass us to a massive ex NFL player for one last attempt at a close and his sheer bulk could be quite intimidating but he was nice actually if pushy. Also good use of economics to debunk the deal. Our experience also had some dodgy legal terms in it “you get this Deed of Title!!” which were a bit of a warning. We got tickets to three events in Vegas which was great and worth a similar amount. But imagine if you’d signed up to the $43k deal. They only need one of those suckers for every 25 people who stay firm I reckon.

LikeLike

I can only imagine how big the commissions must be. I wouldn’t be surprised if the sales guys got $10k per sale.

LikeLike

We did this in Orlando for Disney Magic Kingdom tickets. It took three hours and some exasperated heat on my part before we got out of there. We started the day a lot more stressed than we otherwise would have, for a savings of about, what, eighty dollars? Looking back, I do feel it was worth it, though, because I got a low-risk exposure to predatory, high-pressure sales tactics and a story to tell people about How America Works.

That evening, we found out they’d killed Osama. Disney, timeshares, assassination: it turned out to be the Most American Day Ever.

LikeLiked by 1 person

Yep, doing it once for the experience does have a value: Even before I went to the presentation, I was weighing the value of the future blog post I would write against the risk that it would be truly horrible!

LikeLike

I think when we did our Vegas sales pitch, we must have wavered in our conviction of not wanting in.

They really do bully. No WAY would you want to go solo- you need someone beside you continually saying no.

Free lunch, Madame Tussaud’s and a kind of gondola ride thingie- in addition to crappy samwhiches, juice and Danish’s made it worth it, but it is NOT for the faint hearted or those who do not have a strong will.

LikeLike

I need my timeshare share!

Having never endured such a sales pitch, I feel I am missing something.

Good story.

LikeLike

I you think the maintenance fee of $1,200 dollars a year is reasonable multiplied by the number of units in 52 weeks in a year. $6,240,000 per 100 units! That is insanely expensive. Do the math on the $43,000 purchase and each unit is selling for $2.2M! ($43,000 x 52). Crazy lucrative for the developer, and they can afford high commissions and a low hit rate!

LikeLiked by 2 people

Yeah, good maths red dog. I went to one in about 1990 and it was $25,000 for 1 month (?) timeshare of a holiday complex in sunny Mildura – not a place that was ever on my holiday radar.

That made it $300,000 for a little unit when a 2 bedroom one in Adelaide was about $80,000. I couldn’t justify it. Especially knowing there were about 50 of them.

Someone was profiting big time and someone was going to get sucked in, and it sure wasn’t going to be me.

LikeLiked by 1 person

You guys are funny!!! But of course the ones who do own timeshare and are very happy with it will not waist there time posting here. So on there behalf here I am wasting my time to share my experience with you guys who think your just beating the system. Kind of like you guys wasting your time going on presentations complaining about the salesman just so you can get something for free “how embarrassing”. Its like people collecting disability or unemployment when your perfectly healthy.

I own my timeshare out right and pay around 1100 a year. I take about 4 weeks vacation a year for 1100. Where can you do that? Sure I have to add in the buy in cost, so with that in the equation I already offset my whole entire timeshare cost with fees included from what it would have cost me had I rented from the resorts.

Don’t concern yourself with what the company makes from selling it to you. If that was the case you wouldn’t be buying a LV purse for $200 – $400 knowing it cost only $10 to make.

LikeLiked by 1 person

I purchased a time share many years ago Kona Coast II Resort on the big island of Hawaii. For 10g for 1 week

Was told that there would not be any more development on the Island and that the time share would increase in value. Of course this did not turn out to be true. The time share was for a specific season time. Costs for maintenance if I remember correctly was 600+ a year.

12 years later I could not even find someone to sell it for me. Finally found someone on the island and sold it for about 1g.

I am not going to go into all the details of why a time share a total rep off and unenforced by our government.

So I well leave you with this.

I called the resort and said I am a person off the street and would like to rent for 1 week. The gal at the desk said. No problem, when would you like to reserve. I said Christmas Time, knowing this was the most prime time and cost more in timeshare. She said no problem and gave me a price. It was 300 dollars more than my maintenance fee!!

So a person could just pick up the phone and have everything I did for 300 dollars more. AND any time of the year. Were mine was locked in a particular time frame/season. So lets do the math.

$10,000 cost+$600 maintenance – $300.00 saved vs person off the street= $9700.00.

$ 9000 lost in sale.

Bottom line. Just pick up the phone and make your reservations.

LikeLiked by 1 person