Talk about killing negative gearing is like elevator music in our national debate. It is ever-present and we’ve tuned it out.

But there will never be a better time than now to rip negative gearing from the tax code. That’s because right now investor activity in the housing market is a major macroeconomic problem.

The RBA would love to cut official interest rates – if it weren’t for the strength in housing. It is worried trimming the interest rate even more could create further mad results, like this terrace house around the corner from me that sold for $1.96 million.

This is what Glenn Stevens said last month.

“A situation where:

- prices have already risen considerably in the two largest cities (where about a third of our population live)

- prices are rising, at present, faster than income by a noticeable margin, and

- an important area of credit growth has picked up to double-digit rates,

should prompt a reasonable observer to ask the question whether some people might be starting to get just a little overexcited.”

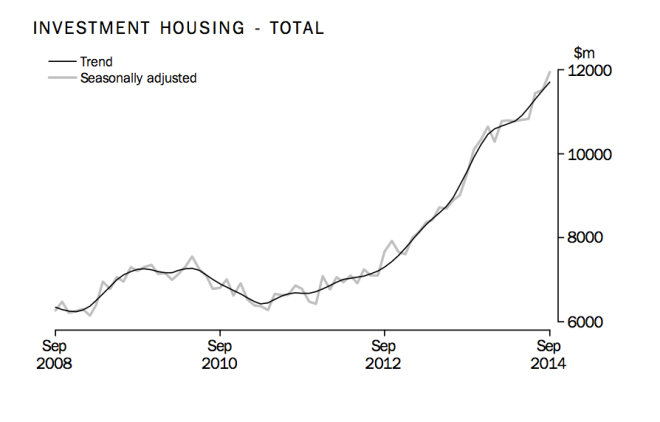

The strength in housing is very much on the investor side, not the owner-occupier side.

The share of lending going to investors is at historic highs.

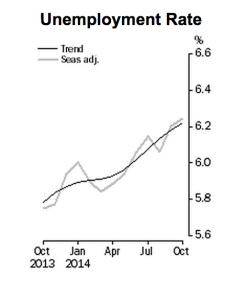

And the rest of the economy is in a morass with unemployment moving sluggishly higher.

If the strength of the housing market was more in line with the rest of the economy, rates would fall like a tonne of bricks. Reducing investor demand for housing could give the RBA the freedom it needs to cut rates to the point where the economy picks up.

In summary, this is what the experts call a policy window.

If there was ever a time where scrapping negative gearing (on existing homes at least) was going to fly, it would be when the topic is macro-economically important.

Negative gearing has haunted the Australian policy landscape since 1985, doing much to enrich property investors while having an altogether ambiguous effect on the social outcome it was designed to address – housing affordability

A brave treasurer would reach back to the Henry Review and say, ‘ in order to reduce the policy bind the rba finds itself in, it’s high time we looked at this recommendation.’

The Treasurer would find plenty of backing in the Henry Review. It did not argue that cutting negative gearing would cause an immediate reversal in house prices. But it did point out that the policy represented a big fat subsidy, and recommended something a lot more modest.

“When negatively geared, asymmetries in the treatment of expenses and receipts give rise to a more favourable treatment (see Chart A1–20). This asymmetry ranks amongst the greatest tax induced biases to the savings choices of households. “

The beat of the drums against negative gearing will never be louder than now. Let’s see if policy makers can hear them.

This is true, but I think an equally effective thing to do, and perhaps better in terms of macro stability that quarantining negative gearing, is to remove the CGT discount that applies to assets held longer than 12 months (all assets). In Germany, for example, you pay the full highest marginal rate on capital gains unless you’ve owned the asset longer than 10 years.

This would decrease speculation on all asset markets, not just housing. And by itself would decrease prices more than negative gearing quarantining, as I have shown in previous modelling.

http://www.macrobusiness.com.au/2011/12/negative-gearing-price-impacts-modelled/

For me it is a much easier sell politically – it doesn’t seem to trap ‘mum and dad’ investors saving for retirement, because they should be holding assets for the long term.

What do you think? Let’s get this idea out there!

LikeLiked by 1 person

I’m very interested in that idea. I think treating all assets equally is probably very smart. But I’d like more detail on what you mean my ‘better in terms of macro stability’.

However I think this policy is likely to be even less popular than negative gearing. 10 years is a long time – long enough to have enough kids that you *have* to move house!

I’d maybe support a higher tax on capital gains where they are above CPI, if we also got rid of stamp duty. Otherwise the tax on moving house might get ridiculously high, creating other distortions…

LikeLiked by 1 person

There is no need to own a home. The Swiss have one the lowest home ownership rates in the world. They just move to another rental property when the need arises.

LikeLiked by 1 person

The strength in housing is very much on the investor side, not the owner-occupier side.

Where’s the data to support this assertion? You present a graph showing a rise in investor activity, but nothing showing a corresponding lack of growth in owner occupier activity.

LikeLike

a quick google search turned this up: http://www.roymorgan.com/findings/5595-growth-in-investment-property-loans-outstrip-owner-occupied-loan-201405190533

“Over the last four years the number of investment property loans in Australia has grown by 37% compared to an increase of only 4% in the number of owner occupied loans. These are the latest findings from the Roy Morgan Research Consumer Single Source survey of approximately 50,000 people per annum.”

LikeLiked by 1 person

You make a very good point. I’ve added a link below that chart that leads to a story explaining the rise in the share of investor lending to historic highs.

LikeLike

What a bonkers price for a terrace in Clifton Hill. All we do in Oz is talk, we’re so far behind the 8 ball in the majority of things we do. Our short sighted politicians are killing us in softly but surely. I just feel sorry for our kids trying to build some sort of life which usually starts with a home at an affordable price.

LikeLike

Surely the only fair and economically correct manner to handle capital gains is to adjust for inflation, and also to discount the tax on savings interest the same way? We should only tax “real” gains!!

LikeLike

This seems very smart and completely sensible and I’m not sure why it is not part of mainstream argument.

LikeLike

I’d be interested on how you propose to manage the numbers around investment properties. Assuming the property makes a loss, I am unable to reduce my personal income tax (no negative gearing). Won’t that just reduce to CGT bill further down the track when the property is sold? Could you have a situation where I keep a property for 8 years and make an up front profit of 200k yet that diminishes due to interest and others cost of buying and selling the real estate totalling 210k. So there would be no CG so there would be no CGT liability (under this scenario).

LikeLike

Interesting question. If I understand it right you’re asking if the costs of managing the investment (the losses) can be netted off the capital gain instead of netted off the income in the year they’re incurred? It’s a good point. My understanding of CGT is you can’t do that at the moment.

Your question makes me realise the real distortion is not negative gearing (you can negatively gear any investment) but the CGT exemption. That’s what only applies to houses. Take that away, the incentives to chase capital gains disappear, and with lower expectations of gains, so do the incentives to negatively gear.

LikeLike

Maybe CGT should be abolished as well and we are just taxed at the current income tax rate on net profits from our investments. Thanks for responding, have a great day.

LikeLiked by 1 person

– A tax break is not a subsidy.

– There is a good deal of evidence to show that the effect of NG on house prices has been greatly exaggerated.

– The property bubble has more to do with economic fundamentals ie. supply not meeting demand, stemming from regulatory disincentives to build new houses.

– We don’need more taxes! We need more houses!

LikeLike

To be logical, if you going to tax gains above some inflation rate, that inflation rate should be wage inflation not CPI inflation. Savings are intertemporal substitution of labour. I choose to either work today or work tomorrow – the relevant inflation measure is wages growth. Even better would be to get rid of CGT since Australia did not have it prior to 1985. This makes since some assets go down and not up (feel free to become a billionaire by making all those capital gains if you are so smart).

LikeLiked by 1 person

You assume I haven’t already become a billionaire from capital gains? ;)

Seriously though your point about what is the best inflation measure to use is one I have been thinking about and you’re not wrong that CPI is a bit of a dodgy choice.

LikeLike

This whole article and the financial parameters charted above highlight a much greater problem. That is the misguided belief that using interest rates is the best way to control inflation. So the dropping of interest rates to encourage investment is fine except it is also fueling a desire to use that cheap money. Even with “too many people taking advantage of negative gearing” i.e. buying property there is still a shortage., hence price increases (Not insignificantly to a possibly temporary surge in foreign investment.) Take away the buyers and of course you could have a sudden reversal in the supply and demand scale…..and the answer to bring about investment will be to drop interest rates if they aren’t already at zero!

Balance in the economy, without wild changes, steady growth in line with the population increases and maintaining interest rates at or slightly below your international trading competitors long term rates is the ideal scenario. It means the cost of investment into production is at. par or better than international competitors and therefore viable long term to compete and/or maintain an edge. Housing is essential to social stability and there has to be a more stable plan to ensure balanced housing supply. It would make sense for superannuation investment in new housing stock as a long term rental proposition. For younger people they could use rent to buy schemes so that the superannuation ultimately makes an inflation proof capital gain, the tenant has security of tenure and a manageable path to ownership. Adequate supply would be readily achievable. Wealth could be spread more evenly through the community. Lower income earners could participate via major super funds. The stepped tax system naturally encourages higher income earners to actively pursue tax reduction strategies. In reality you want everyone to support housing, pursue production without penalty and a sytem with stong “social equity” That is …the belief amongst the group that the system is fair- something we are a long way from now

LikeLike