China’s economic growth has been very strong for a decade, making Australia one of the richest countries in the world. China has buffered us from the GFC, boosted exports, lifted house prices and invested in our businesses.

Forecasts are for more of the same: At Budget time, Australia predicted growth of about 7 per cent for China until 2017.

But Harvard Professor Lant Pritchett is doubtful about those forecasts. The economic development expert has published a working paper full of reasons why China is far more likely to come to a bust than continuing boom. If he is right, the Australian economy will be stuffed (a technical term) and we’ll probably all lose our jobs.

“History teaches that abnormally rapid growth is rarely persistent.”

This is the unique angle of his story. Pritchett doesn’t purport to analyse China in depth. He looks at economic history, comparing China’s streak of success to other countries’ growth spurts, and predicts reversion to mean.

“regression to the mean is the empirically most salient feature of economic growth. It is far more robust in the data than, say, the much-discussed middle-income trap.”

I’m inclined to think this approach has strengths. The current trope about Chinese policy-makers is that they simply set the level of economic growth that they want.

If this is true they are the only country in the world with that power.

What do we really know about the Chinese economic policy-making apparatus? We know only that it has been very successful, according to its own statistics. And everyone acknowledges those statistics are rubbery.

Pritchett compares betting on China to investing in the best-performing managed fund – past performance is no guarantee of future performance, he cautions us.

“The lack of persistence in country growth rates over medium- to long-run horizons implies current growth has very little predictive power for future growth”

Pritchett, it turns out, really hates extrapolation:

“Paul Samuelson’s textbook predicted in 1961 that there was a substantial chance that the USSR would overtake the United States economically by the 1980s. There was a widespread view right up until the end of the 1980s that Japan would continue to grow and outcompete the world. Or in the opposite direction, consider the pervasive pessimism of even a decade ago regarding Africa. Since then, African countries emerged as a majority of the world’s most rapidly growing nations.”

His paper shows the correlation between growth in one decade, and growth in subsequent decades is low: from 0.3 for adjacent decades, down to around 0.1 for decades separated by 20 years.

“The median duration of a super-rapid growth episode is nine years… China’s experience from 1977 to 2010 already holds the distinction of being the only instance, quite possibly in the history of mankind, but certainly in the data, with a sustained episode of super-rapid (> 6 ppa) growth for more than 32 years.”

Pritchett instead suggests China will grow at an average of 3.3 per cent a year over the next decade. That means China’s GDP will be about half of what it would have been by 2033 than if it grew at 7 per cent.

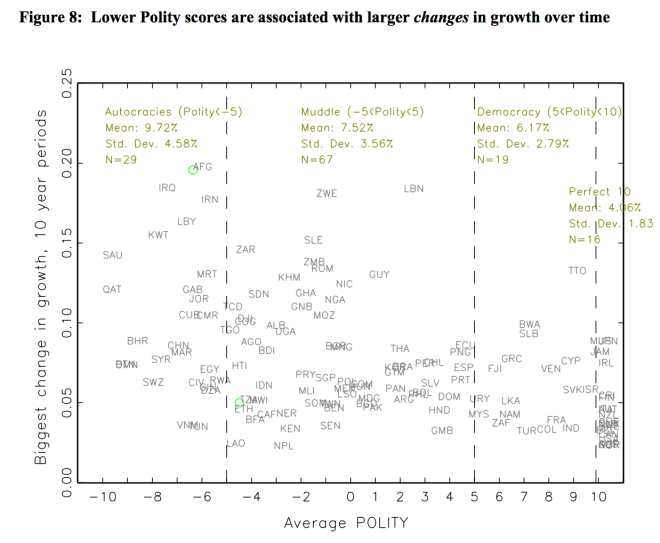

Pritchett does make one concession to analysing China itself, and that is to note that growth is, on average, less variable in countries that are more democratic.

“For China, continuing to have rapid economic growth while maintaining its current level of democracy (as proxied by its Polity score) … would make it more and more anomalous.”

So if China crashes, what should you do?

1. Have a job that doesn’t depend on China (BHP bad, Qantas bad, universities bad, milk exporters bad. Doctor and primary school teacher probably safe.)

2. Have a job that can survive in a downturn. (BMW retailing bad, electricity retailing good)

3. Get out of shares. Australia’s corporate profits depend on Australia’s growth, which depends on exports to China. A China collapse and a stock-market collapse would look like that Olympic event where the two divers leap from the platforms at the same time.

4. Sell your property. China props up our house prices directly (by bidding on them) and indirectly (by making us wealthy). When the firecrackers stop popping in Beijing, auctions in Australia are going to be cold and quiet for a few years.

5. Put your money in a government guaranteed deposit account (and get ready to get very little interest indeed, because the RBA will be busy cutting rates to near-zero.)

In summary, let’s all hope Mr Pritchett is really wrong.

That’s all a bit scary. The only problem is not if things will go pear shaped but getting the timing right – things could easily tick along for a year or two longer. Selling houses is also kind of a big, inconvenient and expensive transaction to make if you get out too early – after all you have to live somewhere and kids benefit from some stability. Are you going to put your cards on the table and predict a percentage fall in house prices in Melbourne or Sydney? They have looked over-valued to me for a good 5 years and they are still stubbornly staying high.

The real problem in opinion is that we have steadily passed on more and more risk to households who are not always well placed to judge it and manage it. They are also not diversified enough to withstand large losses which is what a property crash will do. The ideological culprits for this idiotic state of affairs are from mainstream economics – which is obviously flawed.

LikeLike

Hi Michael, I don’t advocate thinking about selling the house you live in so much as property investments, (which the data suggest are more and more common!)

It may be wishful thinking but if China were to crash I imagine Melbourne and Sydney house prices could fall 20 per cent! I just hope that if that happens I have enough income to actually buy one…

LikeLike

Do you think of Guy Debelle’s speech warning of a sell off?

LikeLike

A small point, but milk exporters won’t necessarily be in a bad state. Chinese people’s incomes can keep growing at the same time that growth plummets, as happened to Japan in 90s.

On the question of property, it may be the case that a downturn in Australian property prices will lag behind China. If a major economic downturn does eventuate in China, you’d expect even more wealthy Chinese will be looking to move to Australia and stimulate demand that way. If worse comes to worse, the Australian government can always tie property ownership to obtaining permanent residence as a way of propping up prices.

LikeLike

I’m curious about your sources for the “China saved Australia in the GFC” theory.

Commodity prices? Brazil is a large iron ore exporter, so too is South Africa and Canada, all went into recession and besides, Australia’s top mineral exports dived in 2008.

Terms of trade? Euro, Japan, Russia all had greater trade relations with China than Australia. All went into recession.

I don’t discount there are other reasons, however, I believe every analysis that you hold for Australia’s economic relationship with China buoying the Australian economy is debunked by facts in other parts of the globe.

Interested to hear your theory.

LikeLike