Like most people who care about economics, read about it or talk about it, from time to time people say this to me:

“I couldn’t get interested in economics. I just don’t care enough about money.”

They say it dismissively. As though economics was about money.

Economics is about people.

Take the latest work by one of my favourite economists, Professor Jeff Borland. He produces a “labour market snapshot” each month that he emails to interested parties. The April one was focused on the plight of the young.

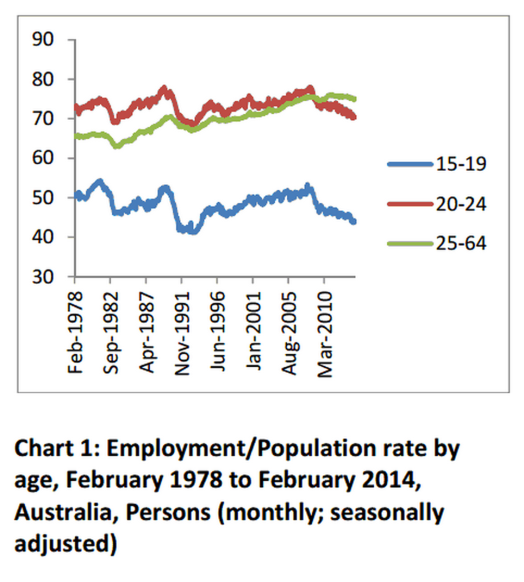

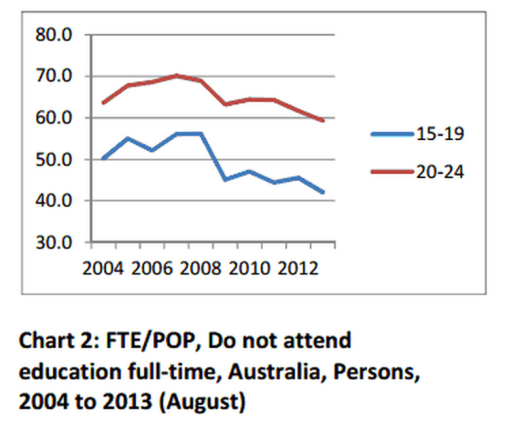

“Employment prospect of the young in Australia have weakened considerably since the GFC,” he writes.

The biggest fall in employment is among those who are not in full-time study.

This is not an academic issue. It’s a goddamn human tragedy. Unemployment at this tender age correlates with worse outcomes on just about every measure.

“Unemployment while young can lead to long-term reductions in wages, increased chances of subsequent periods of unemployment and poorer health outcomes,” according to UK economists.

Brotherhood of Saint Laurence executive director Tony Nicholson: “And in our modern economy that means that they’re really being sentenced to a lifetime of poverty.”

“One in three (32 per cent) long-term unemployed youngsters have contemplated suicide and one in four (24 per cent) in this group admitted to self-harming,” according to a UK survey reported in early 2014.

This blog from the Peterson Institute for International Economics: “Considerable research suggests that less stable employment experiences of young people can lead to “scarring” that affects their future employment and earning prospects.”

The critics of economics implicitly accuse it of reification – that by creating ways of quantifying and measuring the material world they bring materialism to the centre.

There could be a germ of truth there. But to not study the material world in a systematic way would be to deny the real influence it has on humans’ experience of their lives.

“There could be a germ of truth there. But to not study the material world in a systematic way would be to deny the real influence it has on humans’ experience of their lives.”

Thumbs up. When the economy goes bad, people suffer. But there are no short-cuts.

LikeLike

Tom, from a communist perspective, I have to congratulate you on your insight: Karl Marx goes to great length to explain how in capitalism, production relationships are really only the expression of social relationships mis-represented as economic relationships. Marx’s whole criticism of capitalism as ‘Commodity Fetishism’, as the superstitious worship of money, pretty much develops from there.

LikeLike

People make choices in their lives. Many of these are financial or material.

People choose to buy things, or not. Business people make decisions to invest, or not.

All these individual decisions have collective consequences that are measurable. That’s what economics does. It measures the consequences of peoples’ choices.

Decision-making is psychological – and I’d argue, primarily emotional – based on current confidence and future expectation.

So, economics is the mathematical expression of mass or social psychology.

LikeLike

Is it not the understanding of economics which is at fault in such a comment, but the understanding of what money is, and more to the point, what is the cause or basis behind both money and why people wish to engage in ecomomic activities to begin with? Can either exist in isolation?

LikeLike

True, people isoloate money from value: money is the way we communicte value and it helps us allocate effort to what other’s value, if we want them to value it in return. It helps us avoid a long discussion with the butcher on what one’s value is….one merely hands over the money he wants to represent your value of his effort.

LikeLiked by 1 person

Economics is about explaining and predicting human behaviour. Money is a medium of exchange and a convenient measurement to quantify decisions. Even life insurance is quantified into dollar amounts.

Reasons for people’s decisions can be described by the utility derived from those decisions. When those decisions compete with other users, money is often used to decide distribution. And that’s OK. If I didn’t want to pay $300 to go see Ed Sheeran play, I can’t demand he or someone else pay for my ticket, just because I want to go but don’t have the funds or didn’t want to pay that much.

Money doesn’t explain why people would perform random acts of kindness. Utility can. It explains any act of benevolence or non-monetary reward. So economics is a science that seeks to explain these things, although it does suggest that there is some benefit derived from our actions, even if intrinsic and non-monetary.

LikeLiked by 1 person

There are two completely different fields of ‘economics’.

The one is, as you describe, trying to predict human behaviour, although one would think this would be best left to psychology. The problem with using economics as a way to predict human behaviour is that it never asks the question whether or not any particular individual actually wants to engage in economic activities to begin with. I have been studying this area for over 15 years and it is becoming increasing evident that mainstream economics belief that it is inherent in humans to want to truck and barter is false. 400 odd years ago it was a ‘right’ that many people fought for but this was in retaliation to feudalism; today, it is not even choice, everyone must truck and barter or become homeless. The problem with this, is that if the belief that everyone wants to truck and barter is wrong, then the whole field of economics and its assumptions it rests on, at least from this perspective, is wrong.

The second, is that true economics only deals with acts which have legal effect. What granny bakes in the afternoon and swaps with next door for eggs has nothing to do with true economics (although it is about utility) because the swap has no legal effect – it is not a taxable event. Once one sees economics from this perspective one sees that the true motivation behind behaviours is legal, not ‘utility’. Many people do not enjoy their job, because at the end of the week they have nothing to show for it other than the fact that at least now ‘they are not homeless’. True economics does not care whether I spend $300 on a concert ticket or whether I spend it on a TV. All it wants to know is whether I spent it (and hence transferred ownership), or whether I saved it (and hence accumulated ownership).

The irony is that once one studies economics from a legal perspective, one sees that 100% employment is not possible because 100% solvency is not possible. This means from an economic perspective, poverty and homelessness are ‘certainties’. The reason for this is because, as the Bank of England demonstrated in its two publications in 2014 (the facts of which half the British parliament sitting at the time had to admit they did not know) on what money is and how money is created, all money is debt, if all debts were paid there would be no money, the business sector as a whole only profits when households and/or governments go into debt/deficits, paid employment therefore only exists when households and/or government run debts/deficits. The Bank of England pretty much settled the longest debate of all time, that mainstream economics and its ridiculous theories on ‘equilibrium’ and human behaviour are wrong and that true economics is a zero sum game – one mans wealth is another mans debt.

Once one sees how flawed mainstream economics is, you will see why so many people struggle both financially, and psychologically in this world. Money and private property are the ‘products’ of economic activities, and yet, they cannot be had by everyone, no matter how much political reforming we do. People need to start asking the young whether or not they truly believe in the concept of economic action – be prepared because you will most likely not like the answer.

LikeLike

Human cognition is a most splendiferously varied thing.

LikeLike

Hi dingo342014,

In saying that economics is a science that helps explain and predict human behaviour, that behavior is WRT interactions around the exchange of goods & services (G&S.) The psychologists can explain interactions between people in general however economics is reasonably good at predicting behaviour around the exchange of goods and services.

How about this one; if prices go up, less will be demanded but producers would like to sell more. Wouldn’t you agree?

And if tickets to an AFL match (or Utah Jazz) were cheaper, then more people would go and you would have larger crowds. This is pretty predictable as people in large numbers are reasonably rational.

Not sure what real economics is but I like to think that economics is real when the theory correctly explains and predicts the practice. If an economic theory no longer correctly predicts outcomes, then that theory is no longer any good.

By and large, most economics is reasonably good and getting better all the time.

I think the zero sum game you mention could be referred to as the Circular Flow model. Capitalism enables entrepreneural activity which is creative, so this economic theory is very creative. The fact that economies grow (well, growing ones do!!) suggests that something is not zero-sum but creative. Indeed, if banks keep a fraction in reserve and lend out the rest, this is expansionary or creative. If a young couple decide to build a house and borrow to do so, that is expansionary and creative.

Economic theories explain these expansionary and creative forces and so is thus expansionary and creative in its make-up.

LikeLiked by 1 person